Content Overview

Fleetio’s 2025 State of Fleet Management report, based on insights from nearly 300 fleet professionals, reveals the sector’s top trends and operational hurdles. Rising maintenance costs, labor shortages and slow EV adoption remain widespread. Despite 68% using maintenance software, over half rely on multiple tools. Compliance correlates with preventive maintenance, yet many fleet managers still spend 4+ hours weekly on admin tasks. Government fleets lead in EV adoption, while trucking faces fuel pressure. Practical sustainability, smarter tech adoption and resilient supply chains are emerging priorities.

Jump to a topic

- Key Takeaways

- Fleet manager roles and responsibilities

- Primary fleet management challenges

- Fleet maintenance compliance analysis

- Technology adoption trends

- Time spent on administrative tasks

- Alternative fuel adoption in 2025

- Fleet replacement strategies

- The role of policy shifts in fleet strategy

- Industry spotlight: Sector-specific trends

- 2025 trends to watch

- Bottom line

- About this report

Key Takeaways

- 87% of fleet managers oversee maintenance compliance

- 81% of fleets have no EVs in operation

- 68% use maintenance software — but 50%+ juggle multiple platforms

- 30% of fleets report compliance rates below 75%

- 18% spend 8+ hours/week on manual data entry

- 38% replace vehicles based on rising costs — only 15% use asset age

- 63% cite charging access and range anxiety as top EV barriers

- 55% expect positive fleet impacts under new federal policies

Fleet manager roles and responsibilities

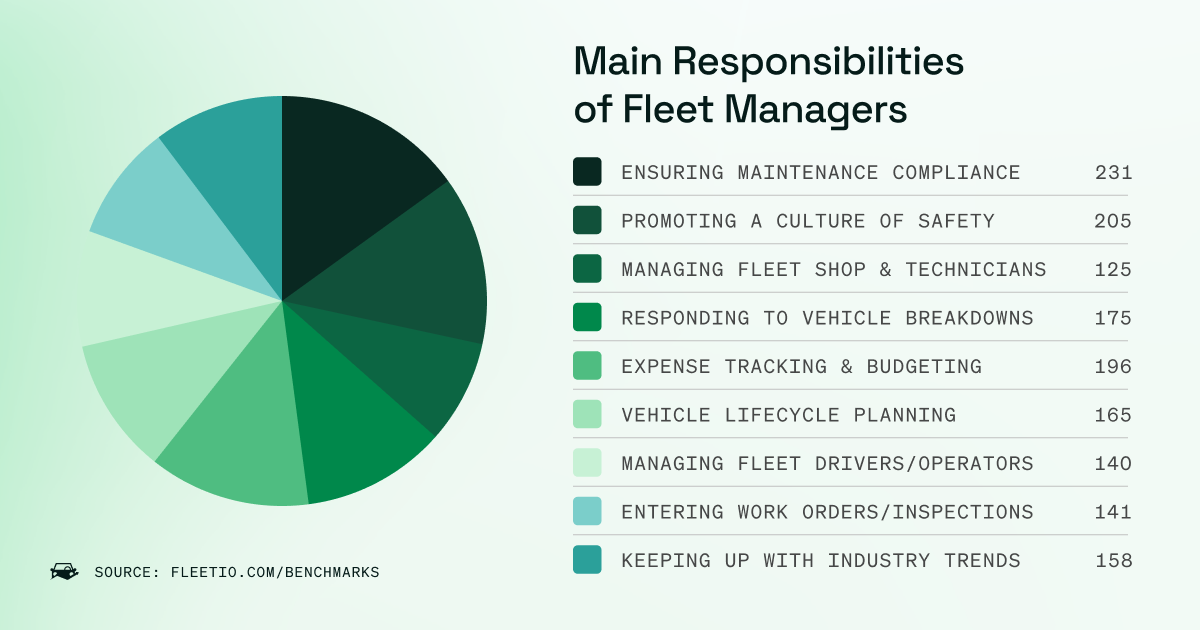

Our survey provided insights into the diverse fleet roles and responsibilities that managers handle in their daily operations:

- Ensuring maintenance compliance (87% of respondents)

- Responding to fleet vehicle breakdowns (78% of respondents)

- Expense tracking and budgeting (76% of respondents)

- Vehicle procurement and retirement planning (74% of respondents)

- Managing fleet drivers/operators (69% of respondents)

- Promoting a culture of safety (68% of respondents)

- Entering work orders and inspections (67% of respondents)

- Managing fleet shop and technicians (65% of respondents)

- Staying up-to-date on industry trends (61% of respondents)

This data demonstrates the multifaceted nature of the fleet manager role, which combines technical expertise, financial management, personnel supervision, and strategic planning. The high percentage of managers responsible for maintenance compliance aligns with the industry-wide focus on vehicle uptime and operational efficiency.

Interestingly, we found variations in responsibility distribution across different industries:

- Construction & Materials: Higher focus on shop management (79%) and breakdown response (86%)

- Trucking, Logistics & Shipping: Greater emphasis on driver management (82%) and expense tracking (84%)

- Government & Municipalities: Stronger focus on procurement planning (83%) and compliance (91%)

- Utilities & Telecommunications: More emphasis on safety promotion (76%) and industry trend monitoring (72%)

Primary fleet management challenges

Six key concerns fleet managers face

Based on our survey, the top operational challenges in 2025 are:

- Rising service and maintenance costs

- Limited vehicle and parts availability

- Technician and driver labor shortages

- Fuel price volatility

- Federal and state compliance pressures

- Complexity in adopting new fuel types and technologies

Pro tip

Fleet leaders who track true total cost of ownership (TCO) can better navigate rising costs and justify long-term investments.

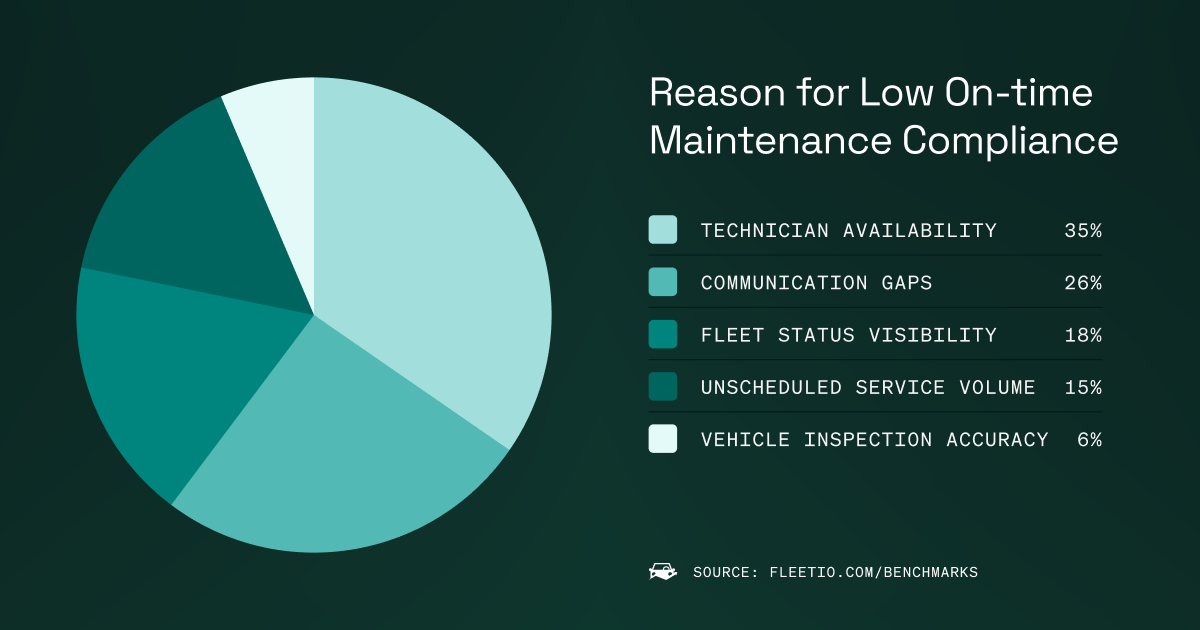

Fleet maintenance compliance analysis

What good maintenance tracking looks like

Only 5% of fleets achieve near-perfect maintenance compliance (95–100%). Most hover in the 75–90% range, but nearly 1 in 3 admit to compliance issues below 75%.

Fleets with higher compliance (85%+) reported:

- 75% scheduled vs. 25% unscheduled maintenance

Fleets with poor compliance (below 50%) tended to:

- Perform < 25% scheduled maintenance

Higher maintenance compliance directly correlates with fewer breakdowns and longer asset lifespan.

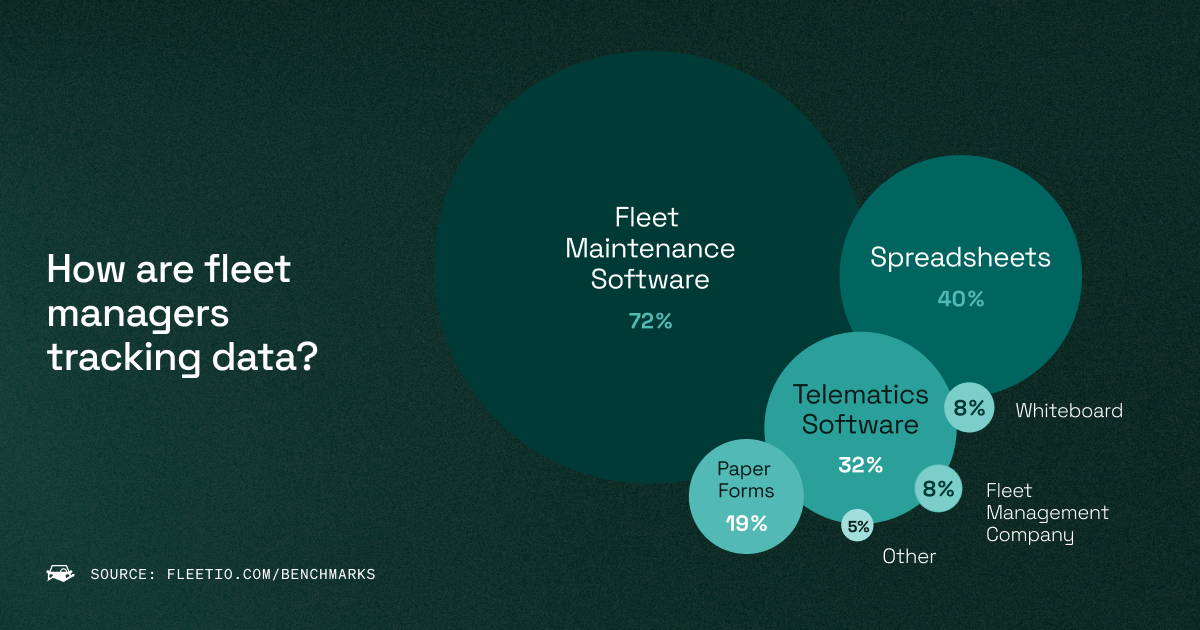

Technology adoption trends

Fleet software usage is up — but integration is still lagging

Survey results show a wide range of tools used for maintenance tracking:

- 72% use dedicated fleet maintenance software

- 32% use telematics software

- 40% still rely on spreadsheets

- 19% use paper-based forms

Over half of fleets using advanced software also juggle multiple platforms, indicating ongoing challenges with software integration.

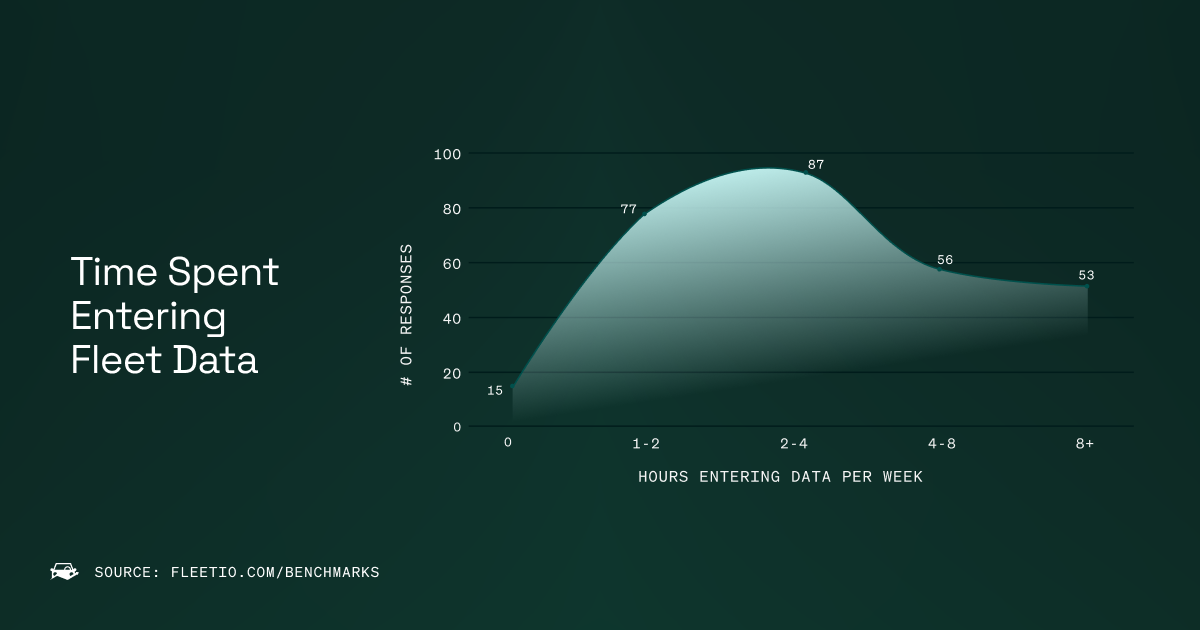

Time spent on administrative tasks

Fleet data entry is still a time sink

Manual administrative burdens remain a key inefficiency:

- 18% spend 8+ hours/week on manual entries

- 57% spend 1–4 hours/week

- Only 5% spend less than an hour

Notably, fleet size didn't correlate with admin hours – staffing levels and tech adoption had more impact.

Alternative fuel adoption in 2025

Low EV and hybrid adoption rates

Despite rising sustainability goals, few fleets are embracing electric or hybrid vehicles:

- 81% have no EVs

- 74% have no hybrids

- Only 2–5% have >15% of either in their fleet

Top concerns around EV adoption

- Range limitations (63%)

- Charging infrastructure (63%)

- Vehicle costs (40%)

- Facility upgrades (54%)

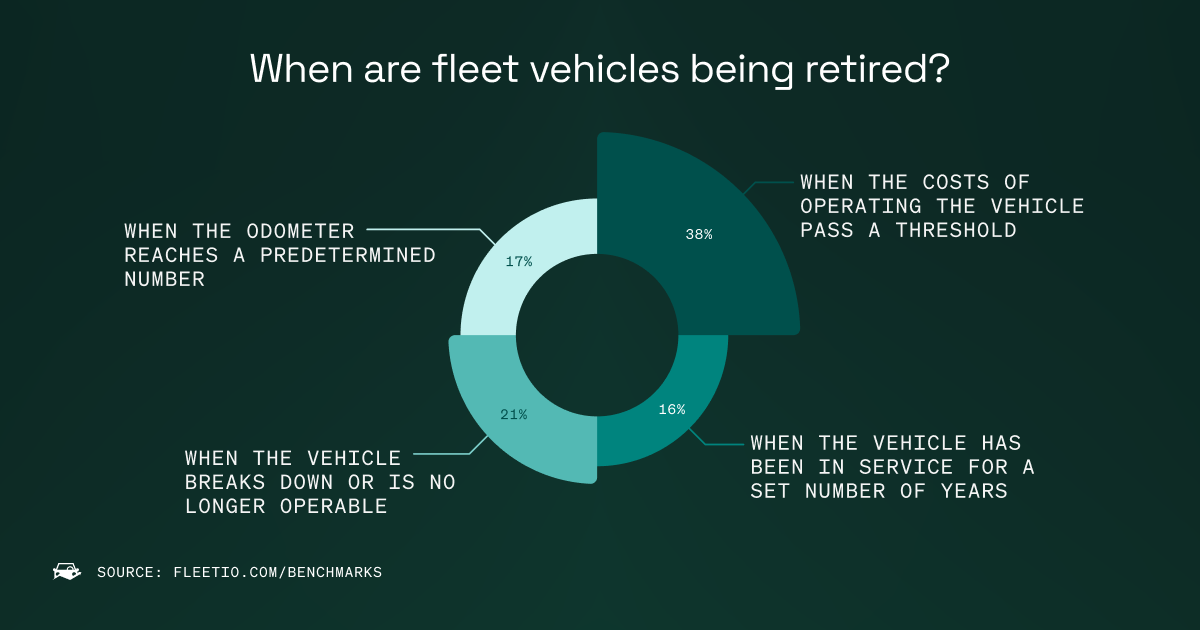

Fleet replacement strategies

How fleets decide when to replace assets

Survey participants cited the following fleet asset replacement criteria:

- 38% replace based on rising costs

- 17% rely on odometer readings

- 15% use time-in-service

- 21% wait until the asset fails

Pro tip

A clear vehicle replacement policy tied to asset lifecycle helps reduce surprise expenses.

The role of policy shifts in fleet strategy

Mixed expectations under new federal leadership

- 55% expect positive impacts

- 15% anticipate negative effects

- 30% expect no major changes

Optimism drivers:

- Lower fuel costs

- Reduced regulatory burdens

- Onshoring of parts manufacturing

Concerns:

- Tariff-induced price hikes

- Lost EV incentives

- Labor shortages from policy changes

Industry spotlight: Sector-specific trends

Construction & materials fleets

- Heavy reliance on reactive maintenance (65% unscheduled)

- Significant tech shortage — especially diesel technicians

Trucking, logistics & shipping

- Fuel cost is the top concern (87%)

- Leading adopters of telematics (46%)

Government & municipal fleets

- Strongest EV adoption (18%)

- Long-term budget cycles drive tech investment

2025 trends to watch

- Data you actually use: Fleets are shifting focus from collecting data to acting on it with tools like predictive maintenance and analytics.

- Smarter sustainability: Instead of going all-in on EVs, savvy fleets are making case-by-case decisions based on use case and ROI.

- Workforce rethinking: Apprenticeships, competitive pay and culture-building are critical as labor shortages continue.

- Stronger supply chains: Fleets are reducing risk with better inventory systems and diversified parts sourcing.

Bottom line: The opportunity gap is growing

The challenges of 2025 are real – but they're also creating a competitive advantage for fleets that move quickly, think strategically, and adopt systems that scale. Whether you’re a 10-asset team or a 1,000+ asset operation, the takeaway is the same:

Adapt now – or risk being left behind.

About this report

The State of Fleet Management 2025 report is based on a survey conducted by Fleetio between November 2024 and January 2025. Responses were collected from nearly 300 fleet professionals across North America, representing a wide range of sectors including government, trucking, construction, utilities and telecommunications. Participants ranged from small fleets with 5–14 assets to enterprise operations managing over 1,000 assets. Surveyed fleets were made up of both Fleetio customers (58%) and non-customers (42%). As a trusted leader in fleet maintenance and asset management, Fleetio publishes this report to help fleet leaders benchmark their performance and stay ahead of industry trends.

It's all in the numbers

Want more insights into the fleet industry? Check out our most recent Benchmarking Report for in-depth analysis of this survey data as well as data from actual fleets in Fleetio.

Check it out