Jump to a topic

Breaking Down the Research

The trucking industry plays a vital role in transporting goods across the U.S. Over the years, the industry has evolved, embracing technological advancements and adapting to changing market conditions. One such condition is the steady upward trend of the truck fleet operating costs, which reached a record-high in 2022 — only for that record to be broken in 2023. ATRI’s recent cost analysis update “found that the marginal costs of trucking, while increasing by just 0.8 percent over [2022], reached a new high of $2.270 per mile.”

“On the one hand, many of the high-level macroeconomic conditions that challenged businesses in 2022 moderated,” according to the report.

In 2023 inflation rates cooled to 3.4 percent, GDP growth improved significantly in the second half of the year, and many cost centers in the trucking industry stabilized. In the freight market, however, contract and spot rates both fell steadily over the year, as did freight shipments, spend, and tonnage. All of these developments put a strain on industry costs and operations.

Fuel, which accounted for a significant portion of the operational cost increase in 2022 actually fell in 2023, moving from $.64 to $.55 cents per mile. Alternative fuel use among respondents jumped to 12.8 percent versus 8.2 percent in 2022, with CNG dominating and hydrogen fuel cell trucks making the list for the first time. Other cost centers, such as truck and trailer payments, repair and maintenance and driver wages, all rose, though at reduced rates compared with 2022. Overall, non-fuel trucking costs rose 6.6 percent in 2023 versus 2022, but the early part of 2024 shows promise. “Carrier fuel and tire expenses were trending downward in Q1 2024 as were used Class 8 truck prices, and changes in repair and maintenance cost increases are below inflation.”

Fleet software designed for trucking

Simplify logistics, reduce costs and keep your fleet on track with tools built for trucking.

Learn moreMake-up of the Sample Group

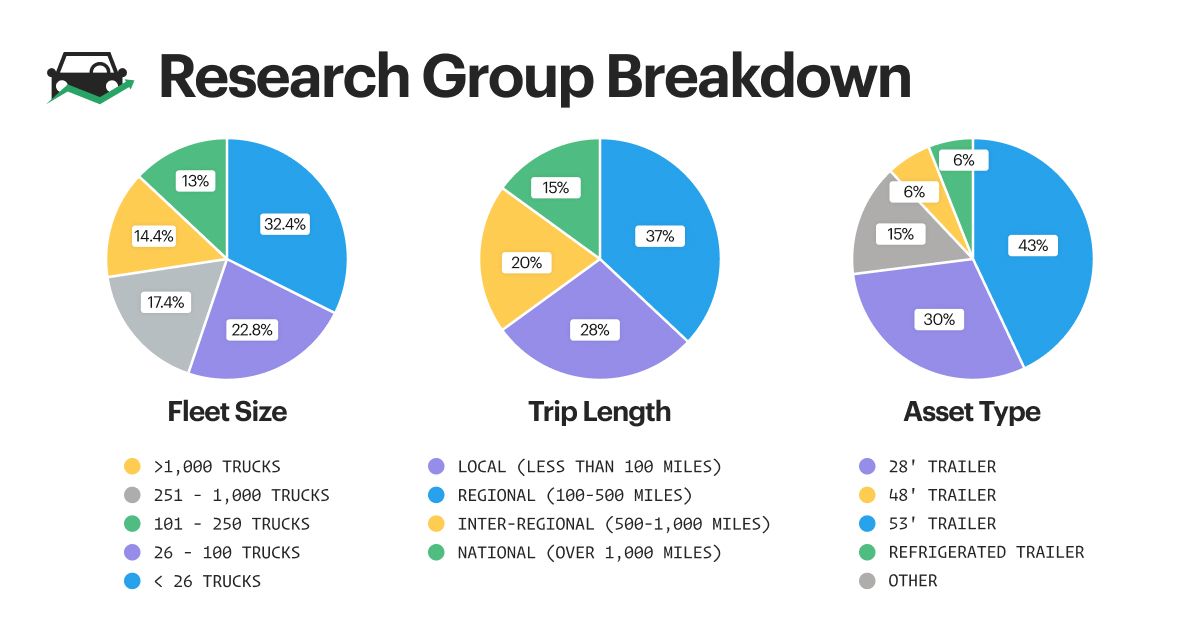

The ATRI report represents a significant portion of the trucking industry, covering data from 150,869 truck tractors, 395,934 trailers and more than 11.97 billion vehicle miles traveled in 2023. The sample group includes fleets of various sizes, with the majority consisting of smaller to medium fleets — reflecting the national trend — as fleets with 10 or fewer trucks make up the majority of motor carriers registered with the U.S. Department of Transportation (USDOT).

Regional Costs

The trucking industry is responsible for transporting the majority of domestic products in the U.S., with regional trucking remaining the most common trip length among fleets. According to the ATRI report, though, some regions are much more costly to operate in than others. “The Northeast reclaimed its spot as the most expensive region in which to operate in 2023 after briefly being surpassed by the Southeast in 2022 [though the] Southeast retained the highest costs in driver benefits.”

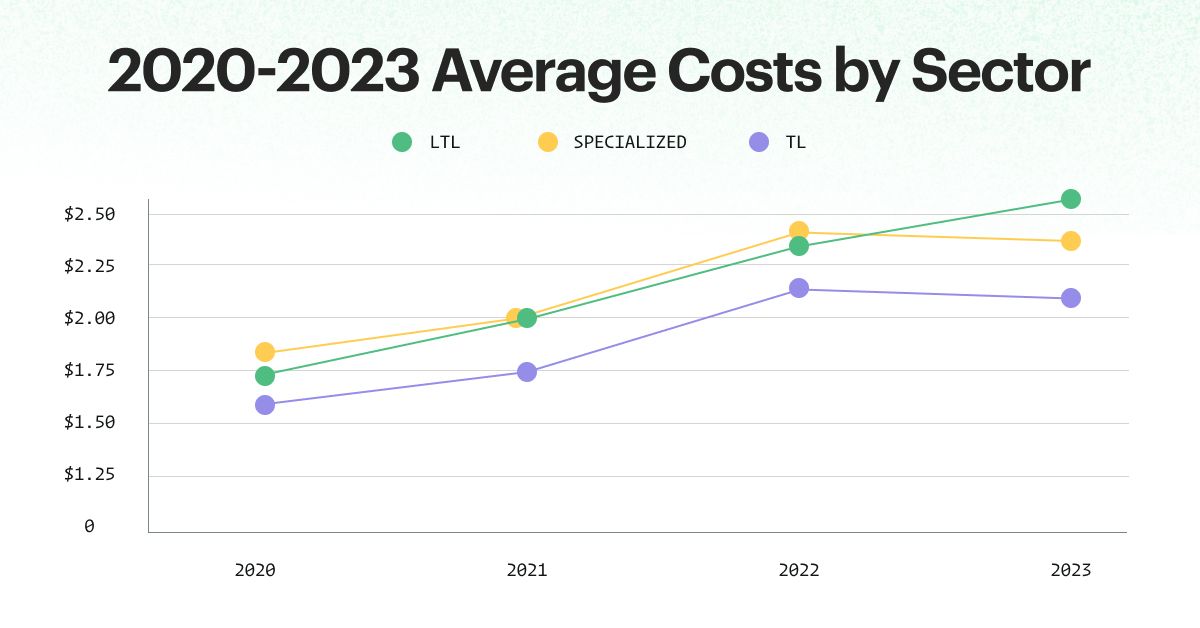

Sector Costs

Different sectors within the trucking industry incur varying costs. The ATRI report found that truckload carriers had the lowest average total marginal cost, while LTL surpassed the specialized sector for highest cost in 2023. Both the truckload and specialized sectors saw reduced costs from 2022 to 2023, while LTL increased; these differences are largely due to fuel costs among the sectors.

Trucking Company Cost Breakdown

In 2024, the trucking industry saw a 3.1-percent reduction in fuel costs and a 1.8-percent reduction in tire costs, with insurance premiums and truck/trailer lease or purchase payments making up the bulk of cost increases at 6.8 percent and 3.8 percent, respectively. Let’s take a closer look at some of these cost centers.

Maintenance and Repair

Service costs rose 3.1 percent in 2023 over the previous year. “This comparatively small change came even as average annual mileage per truck slightly increased and inflation rose by 3.4 percent,” according to the report. “The repair and maintenance trends observed in 2023 persisted in early 2024 and point toward another year of only moderate increases in that cost center.” Service time and technician efficiency also factor into maintenance and repair costs. While technician efficiency showed a four-percent reduction from 2022 to 2023, the average time before getting started on a repair dropped from 2.9 days in 2022 to 2.4 days in 2023.

How to weigh and measure technician performance

Labor

Driver pay rose by double digits in 2021 and 2022, though the rate of growth slowed in 2023, coming in at a 7.6-percent increase. The report notes that “several indicators suggest that this rate of increase may continue to moderate in 2024.” Labor costs in general rose little over consumer inflation — 3.4 percent — which the report suggests may be due to a cooling off in the technician labor market. “Compensation will also experience less upward pressure than in 2022 from inflation rates, which remained consistent in the first four months of 2024 with 2023’s annualized rate of 3.4 percent.”

Fuel

Fuel costs fell 8.8 percent in 2023 compared to 2022, and alternative fuel use among respondents rose from 8.2 to 12.8 percent. According to the report, “In the first two months of 2024, carriers reported a decrease of 3.1 percent in fuel costs per mile on average compared with 2023. Even if the oil market experiences a major disruption in the second half of 2024, fuel costs for the year would likely still average out below the $0.641 per mile spent in 2022, when prices remained elevated for the entire year.”

Cut costs and gain control of your fuel management

Insurance

Marginal insurance costs increased to $.099 per mile in 2023, 12.5 percent over the previous year. “This figure includes auto liability and cargo insurance coverage but not physical damage coverage,” according to the report. In the first quarter of 2024, “the Council of Insurance Agents & Brokers show a 9.8 percent increase in commercial auto rates, exceeding recent averages. Unlike ATRI’s insurance costs – which only include liability and cargo coverages – the figures in these sources include physical damage coverage, meaning that they are more exposed to recent increases in equipment and repair costs.”

The cruise control of cost control

Put your trucking expenses on autopilot with tools that track, manage and optimize your fleet operations — mile after mile.

See how it works2025 Trucking Predictions

2025 brings with it a new administration, which means we’re bound to see some changes in several areas, including reduced emissions regulations and possibly reduced operating costs — though the latter, should it come to pass, will likely be more gradual. Also included among our trucking industry trends for 2025 are market recovery and capacity rebalancing as the industry recovers from what’s been dubbed the Great Freight Recession.

One thing that’s been looming on the horizon since last October is the potential for the International Longshoremen’s Association (ILA) strike to resume in January; however, that is looking less and less likely as the ILA and U.S. Maritime Alliance have struck a tentative deal that would avoid dock shut downs.

Another thing to note going into 2025 is the cost of traffic congestion. In December, ATRI released its Cost of Congestion to the Trucking Industry: 2024 Update. The analysis found that “the trucking industry wasted over 6.4 billion gallons of diesel fuel in 2022 due to congestion, resulting in additional fuel costs of $32.1 billion.” The analysis further forecasts congestion costs to rise to $108.8B.

Strategies for Reducing Trucking Operational Costs

Managing costs is a critical aspect of running a successful trucking fleet. ATRI’s report found that expenses not only rose in almost every cost center during 2023, some actually reached double-digit increases, including truck insurance premiums and tolls. To navigate these increases and improve cost control and financial stability, many trucking fleets are turning to fleet solutions like fleet optimization platforms.

1. Implementing Fuel-efficient Practices

Although fuel costs fell in 2023 and were not expected to reach 2022 heights in 2024, the market cost of fuel is nearly always in a state of fluctuation. Fleets can offset or better adapt to these fluctuations by optimizing fuel efficiency. Fleet solutions provide real-time monitoring of vehicle usage and fuel consumption and allow fleets to quickly source the causes of fuel efficiency issues for both reduced fuel consumption and spend.

2. Optimizing Maintenance Management

The annual change of average operating costs per mile for repairs and maintenance increased 3.1 percent in 2023 and time to service improved, though technician efficiency suffered a bit. Because it’s already one of the biggest cost centers for fleets, repair and maintenance cost control — as well as issue resolution times — is critical. Fleet solutions foster a proactive maintenance process by tracking service histories and sending reminders for scheduled PM, as well as automating service workflows via failed inspection items and DTC alerts.

3. Managing Driver Wages and Benefits

Driver wages and benefits can prove worthwhile cost centers for driver satisfaction and retention. Driver wages in general grew by 7.6 percent in 2023, while truck driver wages showed a 5.5-percent increase. “Some evidence suggests that fleets shifted strategies on which drivers receive the greater share of pay increases,” according to the report. “The National Transportation Institute found that fleets in 2023 gave the largest pay increases to drivers with the most experience – reversing the pandemic-boom trend of 2021 and 2022 [suggesting] fleets are focusing more on retaining proven, safe drivers.” When integrated with driver management solutions, fleet optimization platforms provide driver performance monitoring, which can help promote safe driver behavior, reduce the likelihood of accidents and improve driver satisfaction and retention.

4. Balancing Asset Usage

Balanced fleet utilization is another key cost control component for trucking fleets. Fleet managers and owners can reduce fuel consumption while increasing revenue per mile by minimizing empty miles and maximizing load efficiency. Additionally, balancing asset usage can reduce repair and maintenance spend while increasing fleet output. Fleet solutions provide comprehensive visibility into asset usage, allowing fleets to quickly spot underutilized and overused assets by mileage, status and historical downtime for optimized asset allocation.

Turn asset usage into actionable insights

Fleet solutions also help manage repair requests by streamlining communication between drivers, technicians and even third-party service providers. By centralizing this process, fleet managers can track repair costs, analyze trends and make informed decisions about repair and maintenance expenditures, helping to reduce downtime, improve asset safety and reliability and ultimately lower operating costs.

Making Data-driven Decisions

With many trucking costs on the rise, a fleet optimization platform like Fleetio can prove a valuable source of data for informed cost-control decision-making. Understanding cost metrics and trends in your fleet — and within the industry — can help you make data-driven decisions to optimize your operations. With the ability to monitor and control costs more effectively, fleets can navigate the challenges of the rising operational costs of trucking while maintaining profitability and efficiency.